Are you dreaming of a peaceful retirement in sunny San Diego? Achieving your golden years goals requires meticulous strategy. Luckily, San Diego is home to some of the top income specialists who can support you through the journey. Whether you're looking to boost your savings, ensure long-term growth, or develop a comprehensive retirement strategy, these experts can provide the knowledge you need.

- Top-rated organizations like ABC Advisors offer a wide range of services tailored to your individual circumstances.

- They can assess your current financial situation and help you formulate a plan that satisfies your retirement dreams.

- Avoid delaying your retirement preparation. Contact one of these specialists today and take the first step towards a secure and joyful retirement in beautiful San Diego.

Craft Your Ideal San Diego Retirement

As you approach your golden years in the beautiful city of San Diego, it's essential to construct a solid retirement plan. A knowledgeable financial planner can assist you navigate the complexities of retirement planning and optimize your click here financial well-being.

- A skilled financial advisor will analyze your current financial situation and craft a personalized plan that fulfills your unique requirements.

- They'll recommend investments, manage your portfolio, and provide expert advice on a spectrum of retirement-related topics.

Finding the perfect financial planner in San Diego can feel overwhelming.

Crafting a Dream Retirement in Sunny San Diego?

Relocating to sunny San Diego for retirement is an exciting prospect. With its mild temperatures, stunning beaches, and thriving art scene, San Diego offers an idyllic setting for your golden years. Kick off planning your dream retirement by exploring the diverse neighborhoods that suit your lifestyle. Consider factors like proximity to beaches, amenities, healthcare facilities, and affordable housing options.

- Explore the prosperity of living in different areas of San Diego County.

- Construct a budget that aligns with your retirement goals and desired activities.

- Network with other retirees who have already made the move to San Diego for valuable insights and recommendations.

Best Investments for Retirees in San Diego, CA

Planning for retirement in sunny San Diego? It's a wonderful place to spend your golden years, but making sure your finances last is crucial. Luckily, there are several investment options tailored to the needs of retirees like you. Real in San Diego continually appreciates, making it a classic choice for long-term growth. Bonds offer steady payments, providing a buffer against market volatility. Don't forget about diversified mutual funds and ETFs, which can help you spread your risk and potentially increase your returns. Consult with a investment advisor to create a personalized plan that aligns with your specific goals and appetite.

Maximize Your Nest Egg Income in San Diego

Planning for a comfortable retirement in sunny San Diego is easier than you think! Starting steps to secure your financial future involve understanding different income streams available to you. Explore options like Social Security, pensions, and annuities while investing a diversified portfolio that can weather economic fluctuations. Talk to a qualified financial advisor in San Diego who specializes on retirement planning to create a personalized strategy tailored to your specific needs and dreams.

- Research San Diego's cost of living and plan accordingly.

- Consider supplemental income sources like part-time work or rentals.

- Stay informed about changes in government regulations that could impact your income.

Crafting Your Perfect San Diego Retirement Portfolio

Securing a comfortable and fulfilling retirement in beautiful San Diego requires meticulous planning. A well-crafted portfolio is the cornerstone of this endeavor, enabling you to enjoy your golden years without financial worry. Launch by evaluating your current position. Factor in all income sources, holdings, and anticipated expenses. This comprehensive snapshot will serve as the foundation for your portfolio plan.

Next, determine your retirement goals. Do you envision a standard of living filled with travel, hobbies, or simply spending quality time with loved ones? Express these aspirations in financial terms.

Consider investing in a strategic portfolio that reflects your risk tolerance and time horizon. Retirement accounts like 401(k)s provide tax advantages, while alternative options such as real estate or precious metals can diversify your portfolio.

Seek guidance from a reputable financial advisor to craft a personalized retirement plan. Their expertise will help you navigate the complexities of investing and ensure your portfolio is on track to achieve your goals.

Remember, your retirement portfolio is not a one-time affair. Regularly review its performance and make adjustments as needed to maintain it with your evolving needs and market conditions.

Ralph Macchio Then & Now!

Ralph Macchio Then & Now! Devin Ratray Then & Now!

Devin Ratray Then & Now! Mason Reese Then & Now!

Mason Reese Then & Now! Katey Sagal Then & Now!

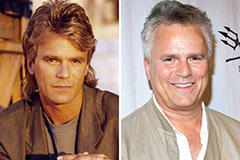

Katey Sagal Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!